Bitcoin L2 Rollup Viability in the Long Run Is Questioned

By Vukan Ljubojevic | TH3FUS3 Senior Writer

August 6, 2024 07:57 AM

Reading time: 2 minutes, 3 seconds

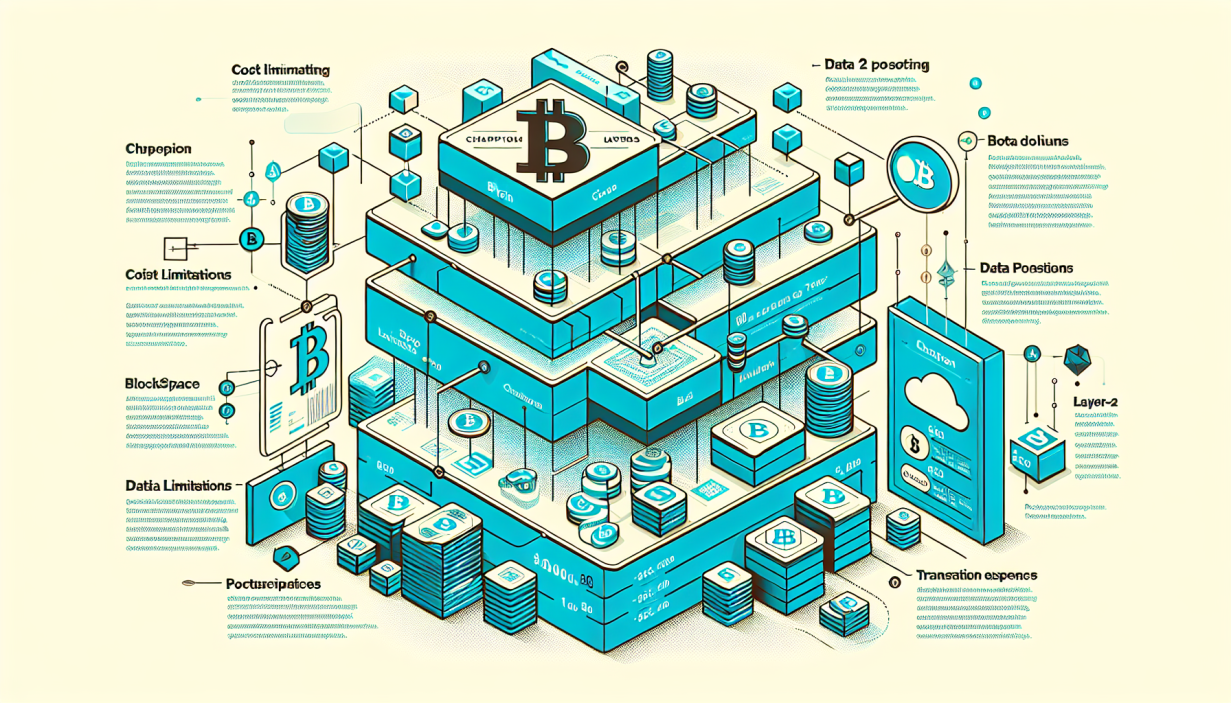

TL;DR A recent Galaxy Research report questions the long-term viability of Bitcoin Layer-2 rollups. These solutions face economic challenges due to Bitcoin's block space limitations and high data posting costs.

The Promise and the Challenge

A recent report by Galaxy Research has raised concerns about the long-term sustainability of Bitcoin Layer-2 (L2) scaling solutions, particularly rollups, a solution widely seen in a positive light to keep transactions cheap, fast, and decentralized.

Despite the initial promise, the report suggests that these solutions may face economic challenges due to Bitcoin's block space's inherent limitations and costs.

Bitcoin's Blockspace Constraint

Bitcoin's blockspace is limited to 4MB per block, a restriction that presents significant challenges for rollups seeking to leverage the network as a data availability (DA) layer.

Rollups, especially those using zero-knowledge (ZK) proofs, aim to anchor their data to Bitcoin's secure Layer 1 (L1) blockchain by posting proof outputs and state differences every 6-8 blocks. However, these data postings can consume up to 400KB per transaction, which is equivalent to 10% of a Bitcoin block's capacity.

Since Bitcoin blocks have been consistently entire since January 2023, competition for space could lead to skyrocketing transaction fees, making it economically unsustainable for rollups and other users.

"Competition for space could lead to skyrocketing transaction fees, making it economically unsustainable for rollups and other users."

Financial Pressures on Rollups

The report highlights that rollups using Bitcoin for DA will need to generate substantial revenue from transaction fees on their networks to cover the high costs of data posting.

For example, at an average fee rate of 10 sats/vByte, a rollup posting 400KB of data every 6-8 blocks could incur monthly expenses of approximately $460,000 or around $5.5 million annually. If the fee rate rises to 50 sats/vByte, these costs could soar to $2.3 million per month, totaling about $27.6 million annually.

To break even, rollups would need many users willing to pay transaction fees ranging from $0.05 to $0.23, depending on the fee rate environment.

Exploring Alternatives

Given these financial pressures, the report suggests that rollups may need to explore alternative DA solutions, such as Celestia, Near, or Syscoin, which offer more cost-effective options. However, this would reduce the rollups' alignment with Bitcoin, potentially transforming them into Validium chains rather than true BTC rollups.

Future Prospects

Another potential solution is for rollups to restructure as Layer 3 solutions, posting state differences to an existing Layer 2 or sidechain.

This would reduce data posting costs while maintaining some connection to the Bitcoin network.

The report concludes that the future of Bitcoin rollups will depend on their ability to balance the high costs of leveraging the network's secure infrastructure with the need to attract users and generate sufficient revenue.