Reddit's Big Leap

From Social Platform to Public Entity

March 4, 2024 11:20 AM

Reading time: 1 minute, 40 seconds

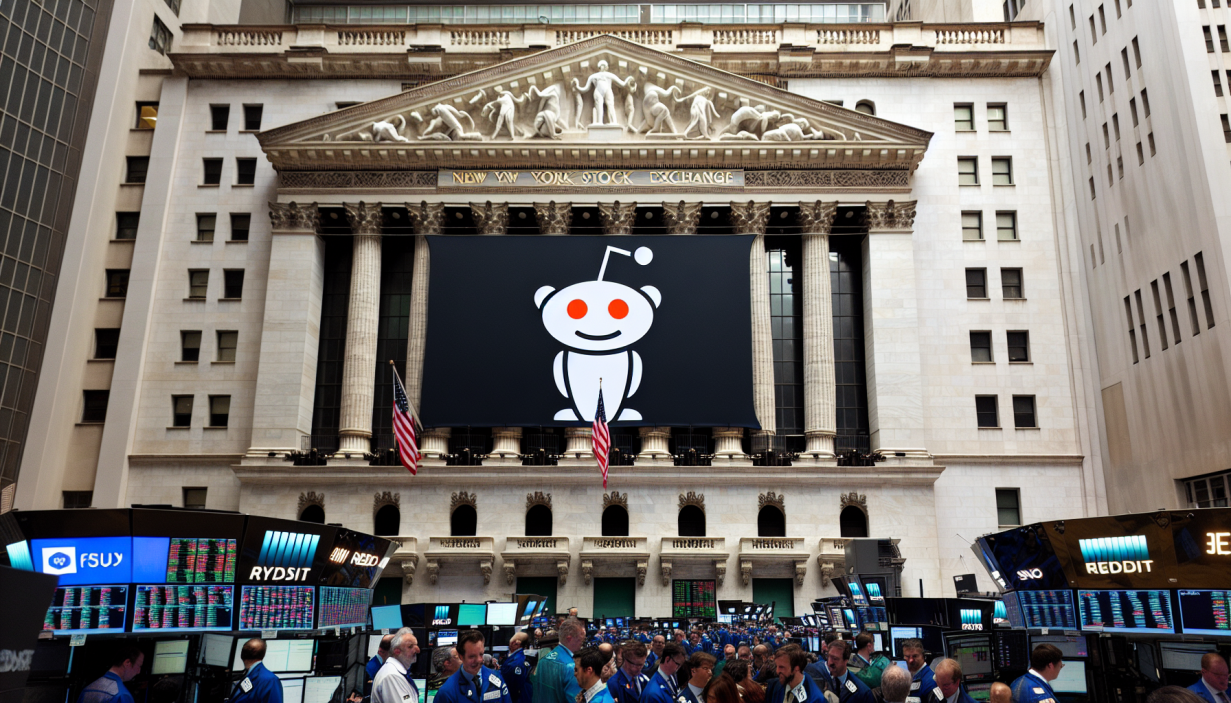

TL;DR Reddit is set to make its debut on the New York Stock Exchange under the ticker symbol RDDT, marking the first social media IPO since Snap in 2017. With a unique community-driven model, Reddit's journey to profitability and its strategic monetization efforts are under the microscope as it approaches its public offering.

Reddit, the social media platform known for its community-driven content and diverse forums, is poised to debut on the New York Stock Exchange with the ticker symbol RDDT. This event marks a significant milestone as it would be the first social media company to go public since Snap's IPO in 2017. Reddit differentiates itself by prioritizing individual passions and fostering tight-knit communities over viral fame and friend connections. With 73.1 million daily users and over 100,000 forums, it has a devoted but yet unprofitable following.

Despite its strong user engagement, Reddit's financials have shown a consistent lack of profitability. However, the company is narrowing its losses and diversifying its revenue streams. In 2023, Reddit reported a 21% increase in revenue, reaching $804 million, and improved its average monthly earnings per user. Yet, the company still faces a significant challenge in turning a profit, with a $91 million loss reported in 2023. The upcoming IPO, seeking a $5 billion valuation, is seen as a crucial step towards achieving financial sustainability.

Reddit's monetization strategy includes a premium ad-free experience, AI data provision, and heavy reliance on advertising. The partnership with Google, worth $60 million, highlights the platform's value in providing data for AI and sentiment analysis. Additionally, Reddit aims to monetize its user economy through enhanced tools for creators and a community marketplace. These efforts are part of a broader strategy to capture a larger share of the digital advertising market.

However, potential investors should consider the challenges Reddit faces. The platform's reliance on advertising and its user base poses risks, including the volatility of online advertising and user dissatisfaction with changes. Furthermore, competition from startups and the potential commoditization of its AI-driven revenue streams could impact Reddit's growth.

In conclusion, Reddit's IPO represents a significant moment for the social media industry. Its unique community-driven model and monetization strategies offer potential for growth, but investors must weigh these against the platform's ongoing losses and the challenges it faces. As Reddit prepares to go public, the market's response will be a critical test of its long-term viability.